As the country’s eyes turn to the upcoming election this week, we’ve gathered our thoughts to signpost where we think the next government has to act to increase affordable housing delivery.

The latest GLA statistics present significant challenges impacting the Affordable Housing sector, with a 90% decrease in affordable housing starts in the previous period to March 2024.

The decrease in starts can be attributed to the development headwinds currently facing the industry: spiking build costs, interest rate rises, a collapse in the viability of s106 acquisitions, high profile disrepair cases, the pressure of decarbonisation, and the ensuing changes to fire regulations (with all the planning uncertainty that accompanied it) following the Grenfell tragedy. For both Registered Providers (RPs) and stock-owning Local Authorities, the health of their Housing Revenue Account or internal business plan has substantially weakened under these pressures, leading to a need to make challenging decisions on future investment.

How do we deliver more Affordable Housing?

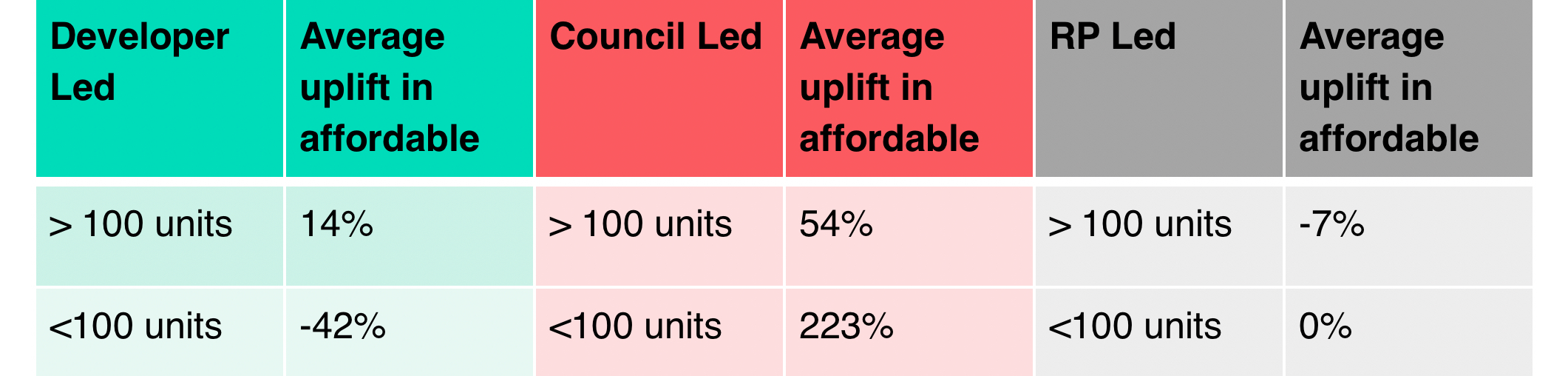

Many of London’s housing estates are at the end of their design life and suffer from under-investment. The Mayor’s policy is that estate regeneration should not only improve the quality of new affordable homes but also the quantum. We have analysed 35 schemes that benefitted from grant in the 2016-2023 programme*, splitting them into which developing entity is the planning applicant and driving force behind the scheme:

We have observed:

- Council-led projects typically deliver more significant increases in affordable housing, regardless of project scale. This may be due to their ability to take a longer term investment horizon with paying back the debt on new Council homes and the political driver to increase quantum.

- Developer-led schemes are usually in partnership with Councils and appointed via a competitive tendering process. For the political reasons above, committing to an uplift, however modest, is likely necessary to secure the development opportunity. The scale of that uplift demonstrates the viability challenges of market-led additionality.

- RP-led projects seem to struggle to provide additional affordable housing on a per unit basis

Is the current grant scheme fit for purpose?

There is more money in the system for redevelopment than for maintaining these estates. There are few business cases that stand up to scrutiny on achieving compliance compared to regeneration – they can be seen as throwing good money after bad. While Homes England having to hand back £600 million of its 2016-2023 grant funding is well publicised, the GLA’s position is harder to scrutinise. However over 9% of the last programme was allocated in its final month (a common feature of the grant funding scheme). The reduction of starts on site suggests this is unlikely to have been spent, yet the availability of grant funding is not the problem. In areas of low capital values, it is essential to bridge the cross-subsidy gap which is unable to significantly bear the weight of reprovided social rent homes alone. These areas are often the most in need of regeneration yet struggle to attract market interest due to the limited profit-making potential.

With the rise in interest rates, we are seeing an increased appetite for partnering patient capital with the public sector to achieve place curation, long term revenue and social impact objectives. The financial arrangements are complex and require scrutiny to ensure vulnerable tenants and the public purse are protected, but particularly for low capital value areas, there is an increased prevalence of opportunity to explore an investment-grade product.

To accelerate affordable housing delivery, proactive Council investment is required supported by a new partnership of patient capital and national developer partners. Our view is that any new government needs to explore a grant regime and commercial powers that can catalyse institutional investment.

Newsteer is leading on the business and investment case for delivery of a number of large-scale affordable housing developments with investment partners across London.

Get in touch with our team to find out more.

Mark Byles – Regeneration Director

Geena Bains – Development Surveyor

Lizzie Sears – Affordable Housing Director